What is the

R&D Tax Credit?

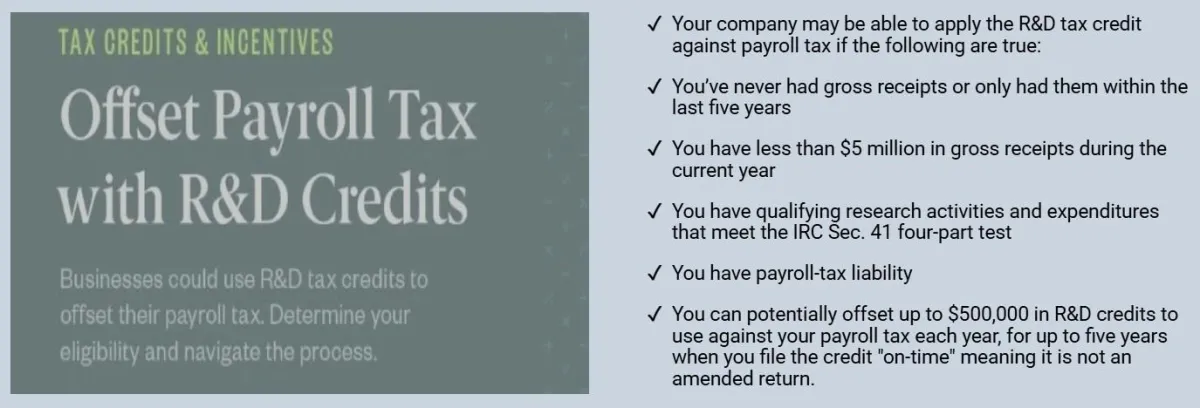

The Research and Development (R&D) Tax Credit remains one of the best opportunities for businesses to substantially reduce their tax liability. For what amounts to their daily activities, companies from a wide range of industries can qualify for federal and state tax savings high enough to allow companies to hire new employees, invest in new products and grow operations. Now, due to recent modifications and expansions over the years, more companies than ever before can benefit from this valuable incentive.

How to Claim R&D Tax Credits

To claim the R&D tax credit, businesses must file IRS Form 6765, Credit for Increasing Research Activities, as part of their timely filed federal income tax return, including extensions. This form reports the qualified research expenses (QREs) incurred during the tax year.

If you missed claiming the credit in prior years, you may also file amended tax returns—typically going back up to three years—to retroactively claim the R&D credit.

Federal and State R&D Tax Credits

Businesses across the U.S. may qualify for valuable R&D tax credits at both the federal and state level. While the federal R&D credit is available nationwide, many states also offer their own R&D incentives.

Each state’s program is unique—some mirror federal rules, others have their own qualifications, benefits, or filing requirements.

Which Activities Qualify for R&D Tax Credits?

Creating improved products, processes, formulas, software, and techniques

Designing tools, jigs, fixtures, and molds

Integrating new equipment

Automating or improving internal manufacturing processes

Automating or improving internal manufacturing processes

Mobile application development

Internet of Things (IoT) development

Development of data center, big data, and data mining tools

Integration of APIs and other technologies

Manufacturing new or improved products

Developing prototypes, first articles, models

Evaluation of alternative materials

Development of firmware

Network hardware and software development and optimization

Developing simulators

*Are you a new business or not profitable yet?

CONTACT US

Have questions or feedback? We'd love to hear from you! Feel free to reach out using the contact form below or connect with us via email or phone. Our dedicated team is here to assist you and provide the information you need. Your input is valuable to us as we strive to enhance your experience. We aim to respond promptly and look forward to assisting you.